In this article, you will learn why you need gross AND net weight, what gross and net weight exactly is, how it results in customs duty amounts and how you can calculate it for cross-border eCommerce.

Why do I need a gross and net weight for Swiss import customs clearance?

In general, customs duties in Switzerland are levied on the gross weight. Switzerland is the only country in the world to do this. All other countries levy customs duties as a percentage of the value of the goods. Accordingly, it is obligatory to state the gross weight - without the corresponding data, the goods may not be imported into Switzerland!

What is the gross weight and what is the net weight?

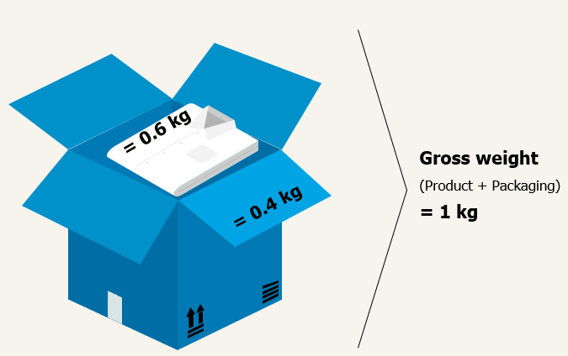

A shipping unit is made up of two components - the items including their immediate packaging (e.g. the protective film for clothing) and the shipping packaging (usually a cardboard box or a paper or film shipping bag).

In the example above, the shirt would have a net weight of 0.6kg but a gross weight of 1kg, as the 0.4kg of the shipping box must be added.

If we had two shirts with a net weight of 0.6kg each in the same shipping box, the 0.4kg of the shipping box would be divided between the two shirts. Ergo, the shirts would have a gross weight of 0.8kg.

How do I calculate the Swiss import duties on my goods?

Here you will find a small calculation example:

| Tare weight of the shirt with direct outer packaging (net weight) | 0,6kg |

| Weight of the packaging | 0,4kg |

| Gross weight of the cotton shirt | 1 kg |

| Customs tariff for cotton shirts | 200 CHF/100kg=2CHF/kg |

| Effective customs duty for the shirt | 2 CHF |

Optimization options for import customs clearance into Switzerland

There are the following vehicles through which you can minimize your customs clearance costs and expenses:

- the type of customs clearance (collective vs. individual customs clearance)

- manual vs. automated, interface-based customs clearance

- the utilization of allowances

- the data integration of returns flows (to avoid duplicate customs charges and unnecessary admin)

- the recovery of already paid Swiss customs duties in the case of returns

In this blog article, you can learn more about customs clearance optimization for cross-border eCommerce in Switzerland.

Would you like a comprehensive PPT on customs clearance? No problem-here you go.

If you would like individual advice, you are welcome to book a free consultation appointment.