Are you an e-commerce merchant who wants to export goods to Switzerland? In this article, we’ll show you how you can simplify this process and make your customs clearance efficient with a CSP account.

What is the centralized settlement procedure (CSP)?

The centralized settlement procedure, or CSP for short, is a service conducted by the Federal Office for Customs and Border Security (FOCBS) in Switzerland. It allows importers and forwarders to pay their customs duties efficiently and without using cash.

Why is the CSP relevant to e-commerce merchants?

As an e-commerce merchant who exports goods to Switzerland, you are faced with the challenge of making customs clearance as seamless and efficient as possible. The CSP can play a pivotal role in this. It allows you to pay your customs duties without using cash and get your goods across the border more quickly.

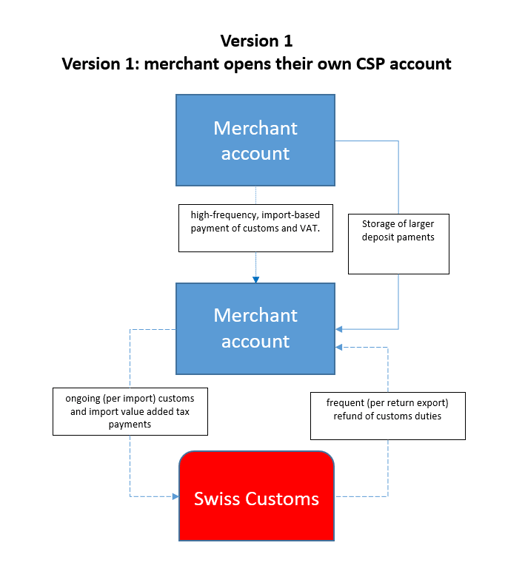

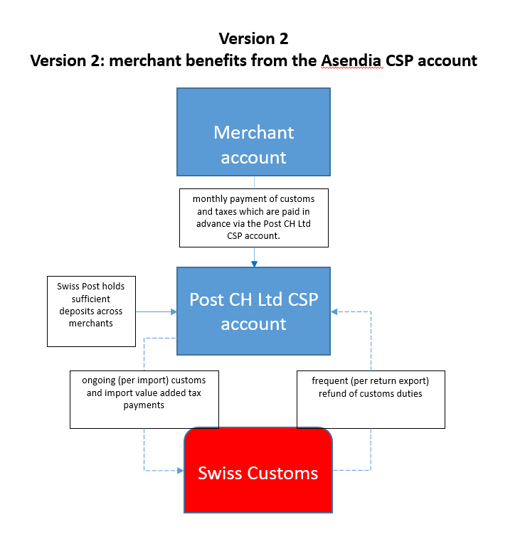

As an e-commerce merchant, you are NOT obliged to open a CSP account. A representative from a service provider can also pay customs duties and VAT on your behalf. This is usually done by a shipping service provider or customs clearance agent. This service usually comes with a disbursement fee. As a merchant, you benefit from not needing to open a CSP account or pay a deposit.

There are two ways to pay customs and tax payments

How does the CSP work?

In the CSP, the customs declaration is made prior to an import as normal. The consignment is released at the border once the relevant clearance application has been accepted and following any possible goods inspections. Import levies do not need to be paid on-site. Instead, electronic tax assessment decisions are automatically created in a digital form and can be downloaded online.

How do I open a CSP account?

To open a CSP account, the FOCBS needs a declaration of membership and a security deposit from you.

What are the preconditions for opening a CSP account?

To open a CSP account, you must fill out a declaration of membership and send it to the finance department of the FOCBS in Bern. By signing the declaration of membership, you agree to all conditions of the CSP. You must also provide a security deposit, paid either as a cash deposit or a guarantee to the FOCBS.

How do I calculate the value of the security deposit?

The value of the security deposit is calculated based on the average duties over two weeks. Here, the security deposit for value added tax (VAT) is usually at least 20% of the VAT charges applicable within a period of 60 days. If you are not registered as being liable for VAT, the security deposit amounts to 100% of the VAT charges applicable within a period of 60 days.

The minimum deposit is CHF 2,000.

The security deposit is always rounded up to the nearest CHF 1,000.

Note: the security limits are reviewed on an ongoing basis. If necessary, you may be asked to raise the limit.

For further details, we recommend visiting the relevant FOCBS webpage on opening a CSP account.

How do I use my CSP account effectively?

Using your CSP account effectively requires a good understanding of payment methods and tax assessment decisions.

How do I pay my invoices with a CSP account?

You can pay your invoices by QR-IBAN with your reference number, by direct debit or by e-billing. If paying by direct debit (recommended), as a merchant your customs payments are virtually fully automated. It is important to keep to payment deadlines: customs duties must be paid within five days, VAT charges are granted a payment deadline of 60 days.

Further information on payment methods can be found on this Swiss Customs webpage.

How do I receive my tax assessment decisions?

Electronic tax assessment decisions are automatically created in a digital form and can be downloaded online. Once you have received your account number, you will find instructions on the FOCBS website on how you can register to receive your documents electronically.

What are the benefits of a CSP account for e-commerce merchants?

The CSP account offers a range of benefits that make the process of importing into Switzerland considerably easier and faster.

How can a CSP account simplify the import process?

With a CSP account, you can pay your customs duties without using cash and get your goods across the border more quickly. A CSP account also allows for efficient management of your customs duties and tax assessment decisions.

How can a CSP account save time and costs?

A CSP account can help save time and costs by allowing you to pay customs duties without using cash and quickly approving goods at border crossings. A CSP account also allows for efficient management of your customs duties and tax assessment decisions, reducing administrative hassle.

If customs and taxes are paid on your behalf by a service provider, they may ask for a flat fee per consignment or a percentage disbursement fee (industry standard is 2%).

You can obtain up-to-date information with this factsheet on the Swiss Customs webpage.