Fiscal representation in Switzerland

Here you can find out everything worth knowing about fiscal representation in Switzerland. Find out about VAT regulations, opening a customs account, different solutions for delivery processing and much more.

Too long to read immediately? Just download the content of this page as a handy PDF and stay on-topic offline.

Everything important about fiscal representation in Switzerland

What is a fiscal representative and what are his functions? Why is it important for owners of online shops who want to send goods from Germany or Austria to Switzerland to be informed about this topic? In this section you will find out everything you need to know about fiscal representation in Switzerland and what it does exactly.Fiscal representation while shipping to Switzerland

Do you distribute goods to Switzerland or are you planning to enter the lucrative Swiss sales market in the near future? Then the topic of fiscal representation in Switzerland is very important for you, your business and above all for your customers.

In 2023, the total volume of all exports from Germany to Switzerland amounted to approximately 67 billion euros. This continues the upward trend of previous years. In order for a German company to take advantage of this trend, to remain competitive and to be able to conduct smooth trade in Switzerland, the Swiss Federal Law on Value Added Tax requires that a person resident in Switzerland be appointed to represent the company as a VAT fiscal representative.

The advantages of a VAT fiscal representation are

✓ Reduction of legal risks for the retailer and final customer

✓ More customer-friendly invoicing that includes VAT directly

✓ Faster repayment of input tax

✓ Process streamlining through significantly lower internal costs

What is a fiscal representative in Switzerland?

Definition Fiscal Representative Switzerland (often also called Swiss VAT Fiscal Representative)

A natural or legal person who, as an economic operator acting on behalf of a non-Swiss company, assumes all obligations with regard to value added tax vis-à-vis the Federal Tax Authority. The VAT representative is not liable for the information provided by the non-Swiss company, as long as it cannot be proven that the non-Swiss company has no intention to break the law.

The function of a fiscal representative is best defined by his field of activity. Federal fiscal representatives are primarily responsible for the following tasks:

- Evaluation of the tax liability

- Official notification and registration

- Acting as an intermediary between non-Swiss companies and the Swiss tax administration

- Accounting of the annual turnover

- On-site correspondence for federal clients and authorities

- Value Added Tax Statement (quarterly)

When do you need a VAT representation in Switzerland?

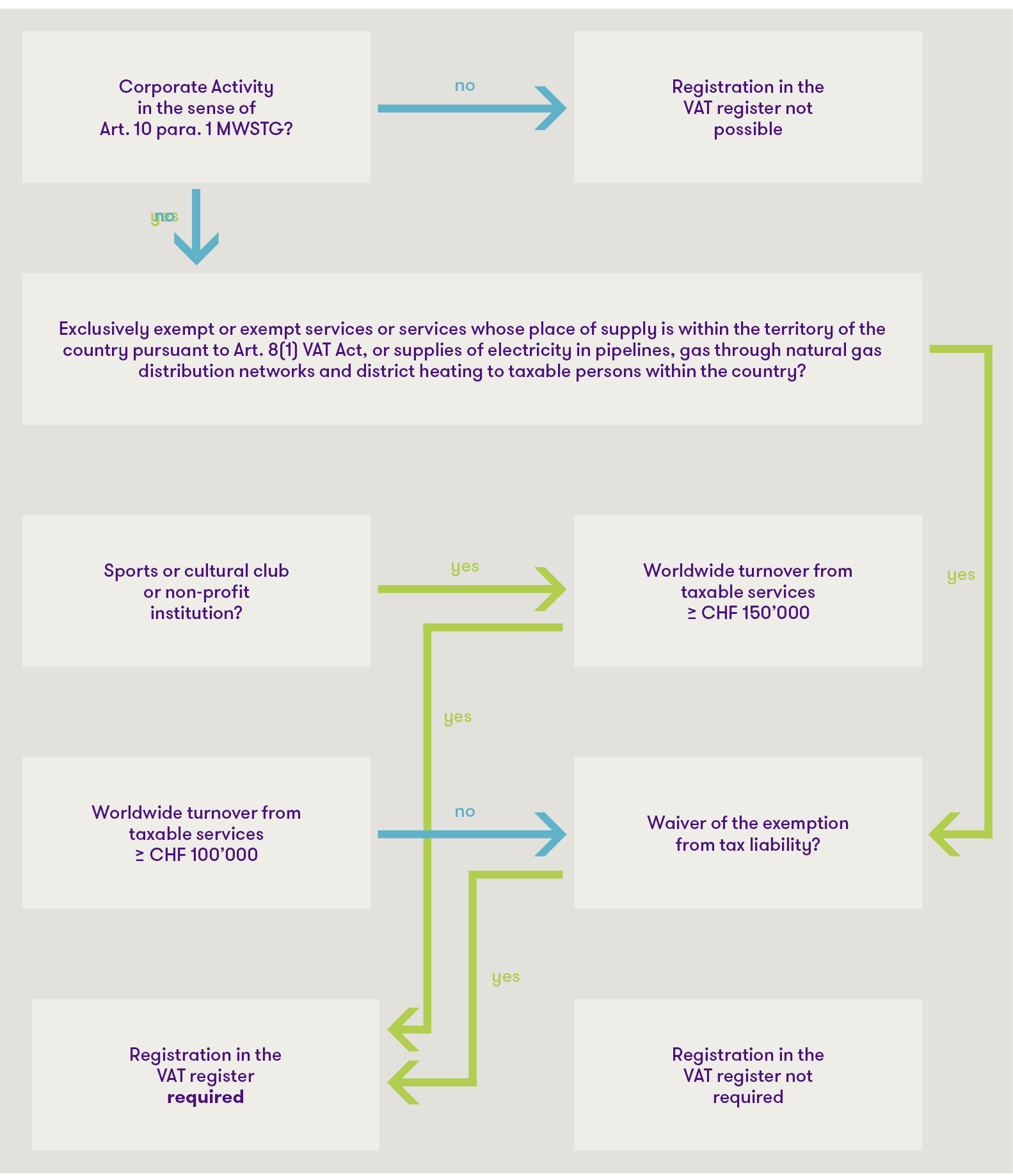

Once you are taxable in Switzerland from the point of view of the Federal Tax Administration, you must be represented by a natural or legal person before the Swiss authorities. If you generate a worldwide turnover of CHF 100'000.– with one of the following activities, your foreign company is taxable in Switzerland from the first Swiss franc earned:

- Mail order business to Switzerland

- Craft and physical services such as repair, assembly, or installation on objects

- Digital services such as software provision and production

- Logistic services such as storage

What does fiscal representation in Switzerland cost?

From experience, it can be roughly deduced that the costs of commissioning a VAT representation in Switzerland for smaller non-Swiss companies are around EUR 2'000.– per year.

However, fiscal representatives in Switzerland cost different amounts depending on the size of the company and the service to be provided and there is no general standardisation of costs. Most of the costs generated by the fiscal representative arise from his or her preparation and submission of your VAT statement. You will receive an exact price estimate quickly, without obligation and free of charge from one of our e-commerce managers. Simply request an appointment for a consultation.

Value added tax in Switzerland

Having established what a fiscal representative is and when you need one, we now turn to the core area of fiscal representation: VAT. The Swiss value added tax (VAT) corresponds to the German value added tax (VAT).

Registering value added tax in Switzerland

In order for your online shop to be allowed to issue invoices with Swiss VAT, you must be registered for VAT. Your Swiss fiscal representative will assist you with the registration. Here you can download a questionnaire for the submission of a tax-efficient delivery process. After completing the registration process, the tax authority will send you your VAT number. The VAT number consists of the company identification number with the suffix VAT. The company identification number itself consists of the letters CHE and a nine-digit number. A Swiss VAT number therefore has the following format: CHE-xxx.xxx.xxx MWST. Even if the Swiss company identification number is abbreviated to "UID", the Swiss number has nothing to do with the European Union VAT identification number, which is also abbreviated to UID.

The tax administration reports the registration of your online shop to the Federal Statistical Office, which publishes your shop in the UID register. The UID Register is a central database that is used exclusively for company identification. The data it contains is limited to the minimum required for unique identification. The core public features of a company include the name and address as well as information on any VAT registration that may have been made.

When you register your company, the tax administration requires you to deposit a financial security, which can be in cash or in the form of a guarantee. The amount of the financial guarantee corresponds to 3% of the taxable annual turnover in Switzerland and amounts to a minimum of CHF 2'000.– (approx. 1'860 euros) but a maximum of CHF 250'000.– (approx. 232'307 euros).

Services in Switzerland are generally subject to value added tax. The standard rate is currently 8.1%. Certain services of basic human needs are subject to a reduced tax rate of currently 2.6%. For example, food, books and medicines are subject to the reduced tax rate.

Value added tax billing in Switzerland

After registration in the VAT register, your online shop is obliged to invoice the VAT on a quarterly basis. The VAT declaration is made electronically via the portal of the Swiss Federal Tax Administration.

If your online shop is entered in the VAT register, it does not have to declare worldwide sales. In the interests of administrative simplification, only sales generated in Switzerland may be declared. Even with this simplified declaration, the conversion of sales generated in euro currency into Swiss francs (CHF) is required. As a rule, the conversion is made according to the exchange rates published by the Swiss Federal Tax Administration.

You can deduct the import taxes as input taxes in the VAT statement, provided the imports were made on behalf of your online shop.

Open a swiss customs account

Companies that regularly export to Switzerland should open a customs deferment account with the Federal Customs Administration. This requirement is met by your online shop. You communicate the customs deferment account number of your online shop to the carrier and customs agent so that they can enter it on the customs declaration.

A customs deferment account offers you a number of advantages. These include, in particular, shorter waiting times at the customs office, since the shipments are already released after acceptance of the corresponding clearance application, provided that the customs administration does not order an inspection of the goods. In addition, customs duties and import taxes can be paid cashlessly. The invoice for customs duties and import taxes will be sent separately by email. In addition, the payment deadlines for import duties are automatically extended. The extended payment period for import VAT is then 60 days plus five days for customs duties. Without a customs deferment account, import duties would have to be paid immediately upon crossing the border.

To open a deferred customs account, you must also provide a financial guarantee, which is calculated according to a defined key of the Swiss Federal Customs Administration. The security can be provided in the form of a guarantee or in cash. The amount of the security is continuously monitored by the customs administration. If necessary, an increase is requested in writing.

You can find more information on the swiss customs regulations in our blog.

For procedural obligations in relation to VAT, a separate customs deferment account also offers you direct access to the originals of the assessment decisions for import VAT. These are issued electronically by the Federal Customs Administration and are considered ideal proof of entitlement to deduct import tax as input tax in periodic VAT returns. Only if your business has its own customs deferment account can you control access to the original import assessments.

For VAT purposes, not only the Swiss territory is considered domestic, but also the Principality of Liechtenstein and, among others, the German municipality of Büsingen. For deliveries to Liechtenstein and Büsingen the same rules apply as for deliveries to Switzerland.

For VAT purposes, not only the Swiss territory is considered domestic, but also the Principality of Liechtenstein and, among others, the German municipality of Büsingen. For deliveries to Liechtenstein and Büsingen the same rules apply as for deliveries to Switzerland.

Deliveries to Switzerland

DDP deliveries Germany – Switzerland

Fiscal representation in itself is only one – albeit important and obligatory – building block in a VAT-optimised cross-border supply process. But what aspects of Swiss VAT must be considered? In the following you will see all the relevant aspects based on an exemplary dispatch process.

Your customer orders in your online shop. During the ordering process the product price is displayed including Swiss VAT. The product price includes transport and customs clearance costs. For your customer it looks as if he is ordering from a Swiss online shop – in other words, he does not notice the "border barrier".

In the language of internationally standardised trade terms, a delivery in which the seller pays all costs up to the buyer's doorstep can simply be described as a DDP delivery. DDP stands for "Delivered Duty Paid". In such a delivery, the benefit and risk of the goods are only transferred to your customer when the goods are effectively handed over. DDP deliveries are the standard in cross-border e-commerce business with retail customers.

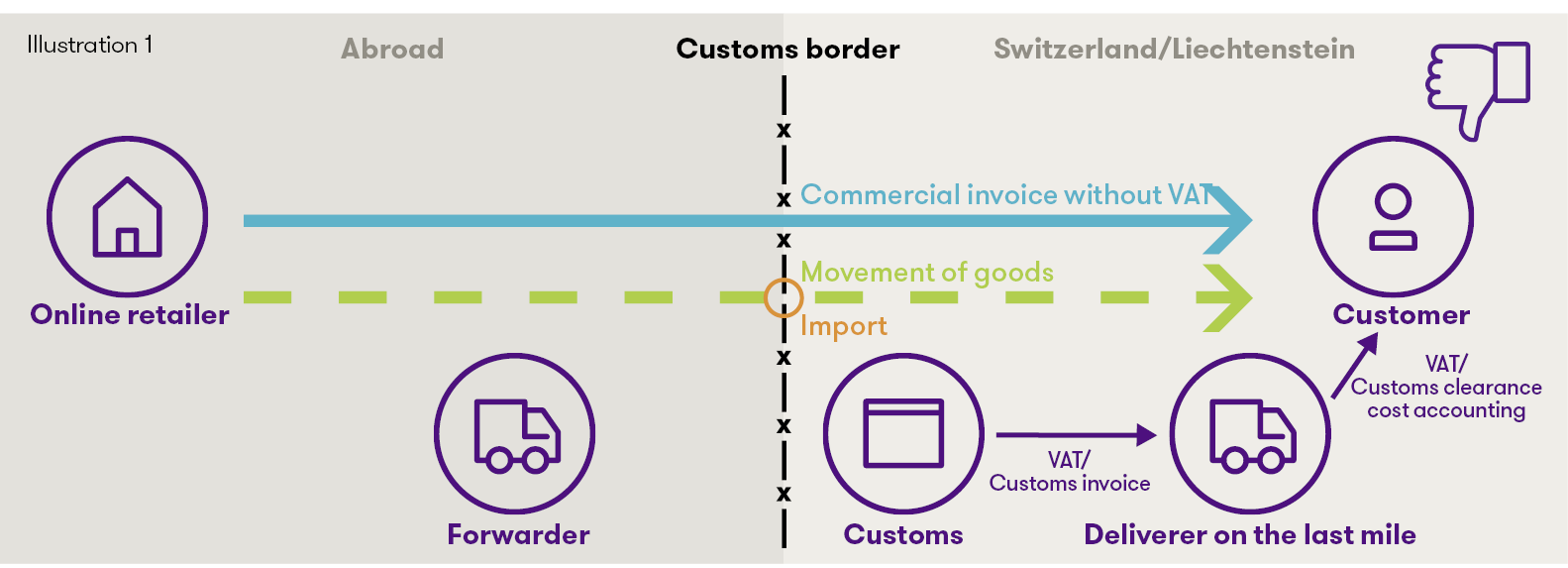

Delivery process without DDP delivery

Without any special tax precautions, the first consignee of goods is considered the importer when sending goods to Switzerland and this person usually owes customs duties, import tax and other fees. This can lead to unpleasant surprises for your customer if he or she receives an additional invoice from the deliverer on the last mile together with the ordered product. The following figure illustrates a delivery where the customer could not order including Swiss VAT in your online shop. This means that your customer will be charged import tax, customs duties if applicable, and additional customs clearance costs by the delivery agent over the last mile.

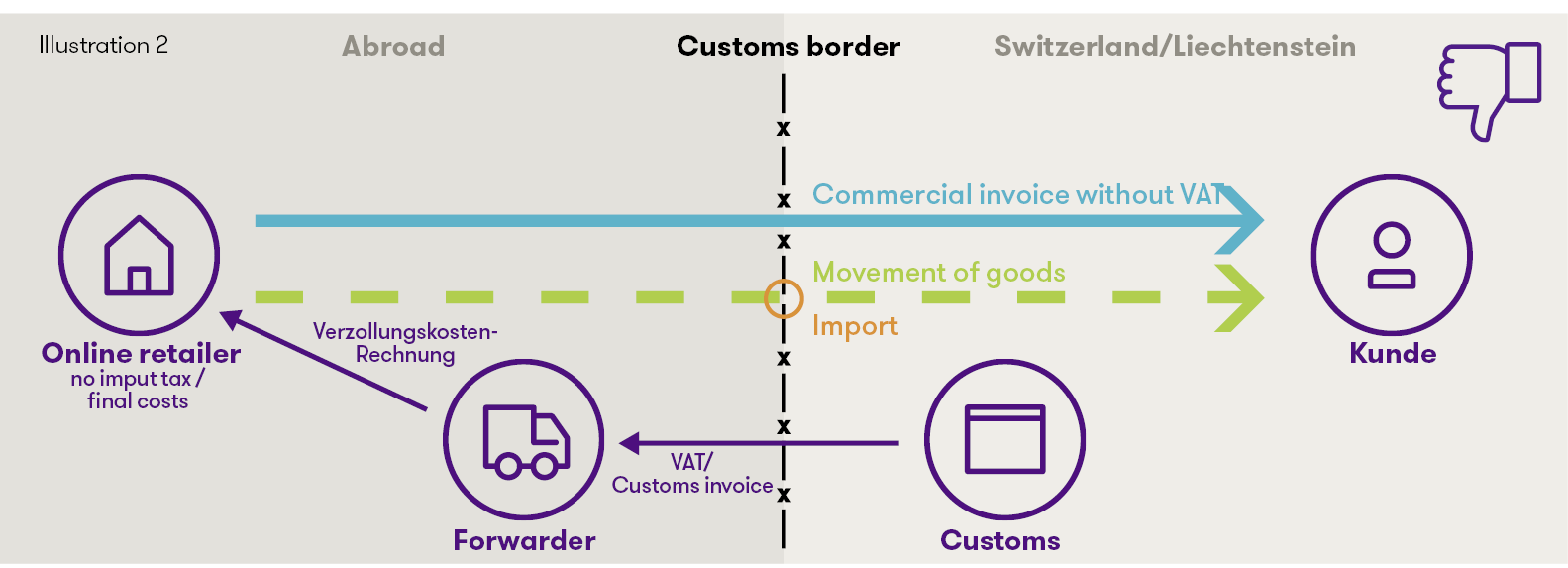

The situation is little better if the freight forwarder pays import tax and other fees on your behalf instead of the consignee. Your customer will not receive an additional invoice from the delivery company on the last mile, but the import tax is not refundable either for the delivery company or for your company. The following diagram shows, that without registration for VAT, import tax is not deductible.

Registration of a shipment for export and import – what do you need to know?

In the background of your online shop, the intra logistics department compiles the order from the warehouses, packs it and prepares it at the ramp for collection by the shipper. The IT system provides the authorised shipper with the necessary data for preparing the export registration. After opening the corresponding customs procedure (transit), the authorised consignor in Germany sends the relevant data to the authorised consignee in Switzerland.

The authorised consignee registers the parcel with the Federal Customs Administration for import into Switzerland. In doing so, he shall provide the Federal Customs Administration with all relevant data for the calculation of customs duties and import VAT.

In case of a VAT efficient import, your online shop is the importer of the shipment. On the import customs declaration, the authorised consignee as importer gives your Swiss fiscal representative the address of your online shop. However, the consignment is not delivered to the importer. Therefore, the authorised consignee under customs law indicates the customer, i.e. the actual consignee of the goods, on the import customs declaration.

When making the import declaration, the authorised recipient also provides the customs deferment account of your online shop so that the Federal Customs Administration can debit the import VAT associated with the shipment directly to your customs account.

In order for your company to be able to import the shipment, you need authorisation from the Federal Tax Administration to import goods in your own name. The application for this authorisation is usually submitted together with the application for VAT. You or your tax representative can apply to the Federal Customs Administration for a customs deferment account.

Parcel transport and delivery to your customer

The carrier takes over the goods ready for dispatch at the warehouse ramp and drives off in the direction of the Swiss border. As the consignment is already correctly declared for export and import and the duties are paid from your customs account, the delivery vehicle crosses the border to Switzerland without delay. Once the consignment arrives at the authorised recipient, the latter notifies the Federal Customs Administration of receivingthe parcel. As soon as the Federal Customs Administration releases the consignment electronically, the transit procedure is completed and the parcel is handed over to the Swiss last mile delivery partner. The Swiss deliverer then processes the parcel in his distribution system and delivers it to your customer free of charge. You can find out more about the wishes of your Swiss online customers in our blog.

Your customer will receive an invoice at the same time, either electronically or together with the shipment, on which Swiss VAT is indicated. On the customer's invoice, your online shop with its German business address is indicated as the seller. In addition, your Swiss VAT number must be printed on the invoice and the other necessary formal requirements must be met. The fiscal representative does not appear on the customer invoice, neither by name nor with his address, to ensure that customers with feedback can address themselves directly to your online shop and that corresponding enquiries can be processed without delay.

An overview of the VAT-efficient supply process

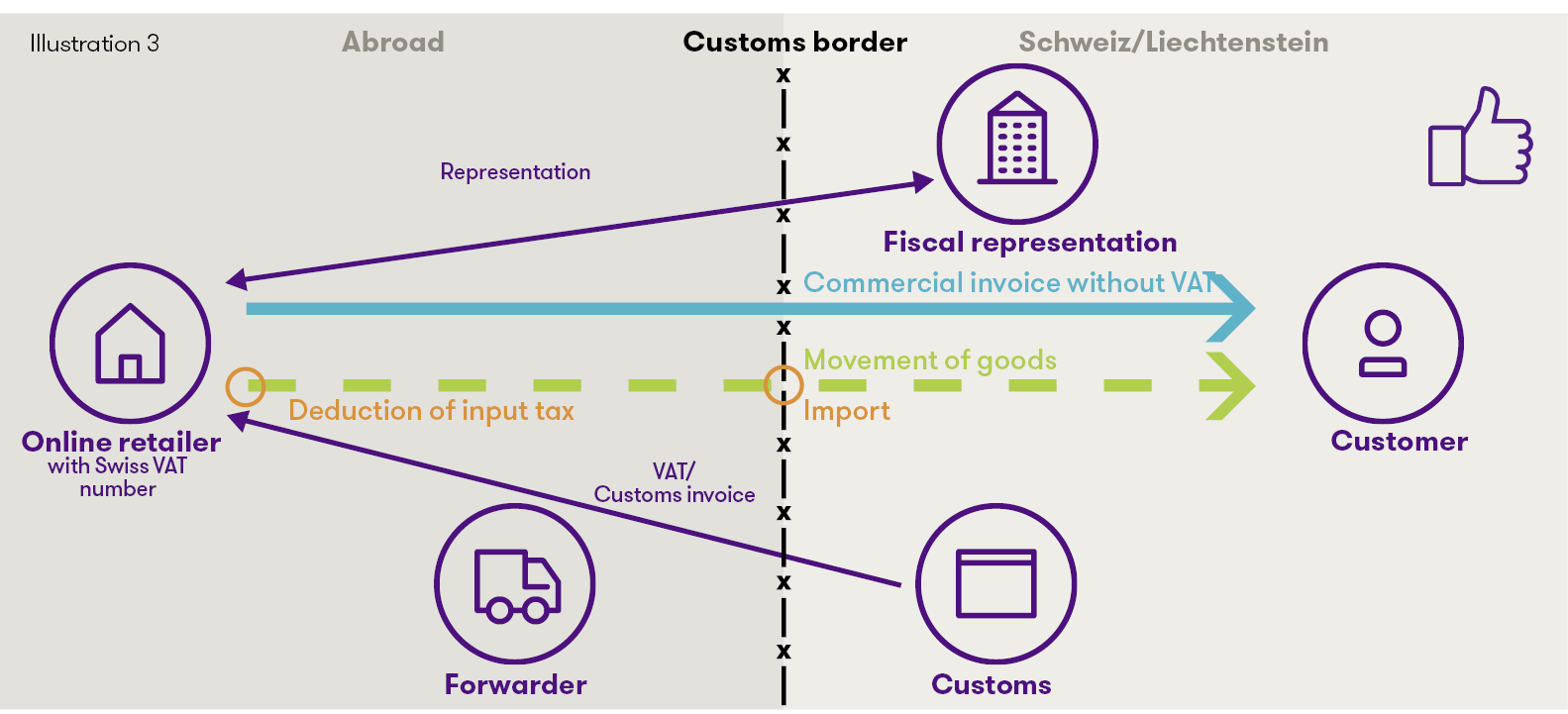

A VAT-optimised delivery process ensures that your customer does not have to pay any additional fees and import taxes when they receive the shipment. In addition, your company can deduct the import taxes from the goods exported in its own name in the VAT invoice. For this purpose, the invoice to your Swiss customer must show Swiss VAT at the applicable rate. The following diagram shows a VAT-optimised delivery process:

With a tax-optimised delivery process, this ensures that your customer receives an invoice including Swiss VAT. Your online shop deducts the invoiced Swiss VAT in the quarterly VAT statements and claims the import tax as an input tax deduction. The consignment is imported in your name on the basis of a corresponding authorisation.

You pay the import VAT with extended payment deadlines via the customs deferment account with the customs administration. Your company can also use the customs deferment account to obtain the original import assessments that are required to prove the corresponding input tax deduction in the VAT statement. Your customer will not notice that the consignment has crossed the border and will receive the order without delay, just as if they had ordered their product from an online shop with a Swiss warehouse.

When is there a mandatory tax liability?

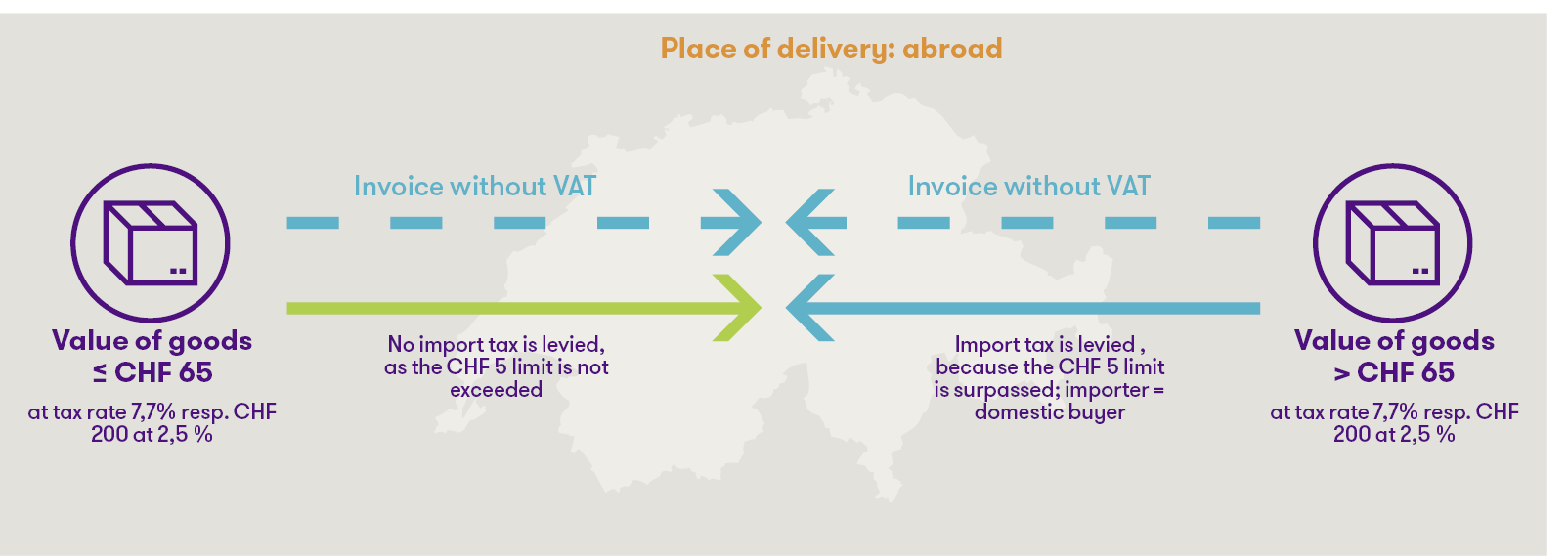

According to the VAT law, the place of supply in the case of a transport or dispatch supply is the place where the transport or dispatch begins. Thus, a person who dispatches goods to Switzerland does not trigger a mandatory VAT liability in Switzerland just for such supplies, as the place of supply is not in Switzerland. This rule can be illustrated graphically as follows:

Your business may, however, import an item into Switzerland in its own name, provided it has a corresponding authorisation from the Federal Tax Administration at the time of importation. This means that the place of supply is in Switzerland, even though the transport or dispatch has started outside Switzerland.

With the following decision tree you can check whether your online shop has to be registered for Swiss VAT if it carries out the imports in its own name.

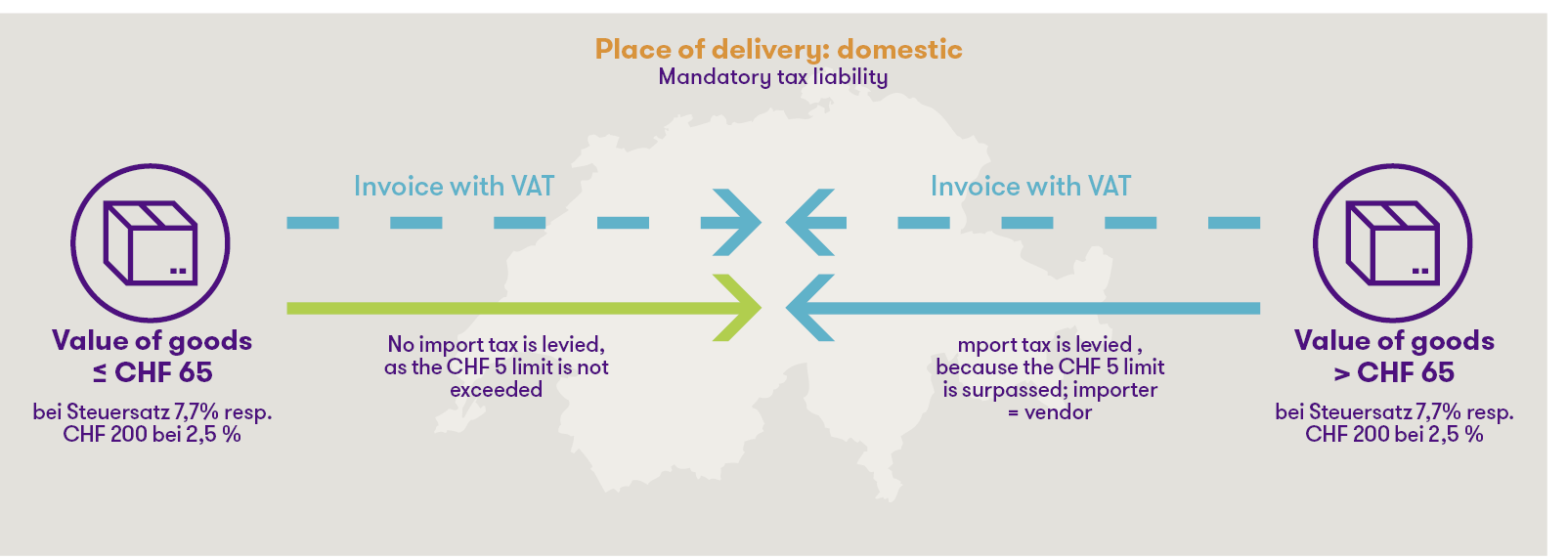

Regular consignments to Swiss customers are also subject to an additional rule for determining VAT liability. If you generate at least CHF 100'000.– turnover per year from consignments to Switzerland whose import tax amount does not exceed CHF 5.–, the consignments are considered Swiss domestic deliveries. Your company must be entered in the VAT register for this. From the time you become liable for VAT, your transport or dispatch deliveries to Switzerland are considered domestic deliveries and are subject to domestic VAT. If your online shop fulfils these requirements, it carries out the importation purely in its own name.

The applicable mail order rule can be illustrated graphically as follows:

How will the tax liability regime be adapted in the future?

The Swiss tax administration is planning to extend and tighten the legal regulations on the tax liability of online shops outside Switzerland in the next few years. The tax administration will be empowered to ban imports from suppliers who are not registered for VAT or who fail to meet their billing and payment obligations and to order the destruction of the goods. In addition, the tax administration will be authorised to publish the names of the rogue mail order companies and online platforms in a register.

Swiss Fiscal representation from one source

Swiss Post convinces online retailers with an all-round logistics solution that not only enables faster deliveries for customers in Switzerland and simplifies returns management, but also offers decisive advantages for the customer when shopping online. As a result, your customers will be significantly more satisfied, build trust in your business and will be happy to shop again. In order to further complete the range of services for you and to make the planning and implementation of your exports to Switzerland simple, transparent and even more customer-friendly, we have brought various partners on board who are absolute experts in this field.

The advantages of a uniform solution from a single source are obvious: two strong business partners take care of the best solution for your business in a centralised manner and thus offer efficient added value that gives you more time for the essentials – to inspire Swiss online shoppers with your offer and to establish long-term customer relationships. Feel free to talk to us directly about your plans and projects in Switzerland. We will support you in all export issues.

Swiss Fiscal representation from one source

Swiss Post convinces online retailers with an all-round logistics solution that not only enables faster deliveries for customers in Switzerland and simplifies returns management, but also offers decisive advantages for the customer when shopping online. As a result, your customers will be significantly more satisfied, build trust in your business and will be happy to shop again. In order to further complete the range of services for you and to make the planning and implementation of your exports to Switzerland simple, transparent and even more customer-friendly, we have brought various partners on board who are absolute experts in this field.

The advantages of a uniform solution from a single source are obvious: two strong business partners take care of the best solution for your business in a centralised manner and thus offer efficient added value that gives you more time for the essentials – to inspire Swiss online shoppers with your offer and to establish long-term customer relationships. Feel free to talk to us directly about your plans and projects in Switzerland. We will support you in all export issues.

Individuelle Lösungen für einzigartige Bedürfnisse

Mit der persönlichen Beratung zum optimalen Versand- und Logistiksetup

Bei der Schweizerischen Post verstehen wir, dass jeder Markt seine eigenen, einzigartigen Herausforderungen hat. Deshalb sind wir hier, um Dich beim Export in die Schweiz oder beim Export aus der Schweiz zu unterstützen. Mit unserer umfassenden Erfahrung und unserem massgeschneiderten Ansatz finden wir gemeinsam die optimale Lösung für Dein Versand- und Logistik-Setup.

Warum einen Beratungstermin bei uns buchen?

-

Massgeschneiderte Lösungen

-

Umfassende Expertise

-

Einfacher Prozess

-

Vertrauenswürdiger Partner

Customised solutions for unique needs

Personalised advice for the optimal shipping and logistics setup

At Swiss Post, we understand that every market has its own unique challenges. That's why we're here to help you export to or from Switzerland. With our extensive experience and customised approach, together we will find the optimal solution for your shipping and logistics setup.

Why book a consultation with us?

- Customised solutions

- Comprehensive expertise

- Simple process

- Trusted partner

Des solutions personnalisées pour des besoins uniques

Un conseil personnalisé pour une configuration optimale de l'expédition et de la logistique

A la Poste Suisse, nous comprenons que chaque marché a ses propres défis uniques. C'est pourquoi nous sommes là pour vous aider à exporter vers la Suisse ou à exporter depuis la Suisse. Grâce à notre vaste expérience et à notre approche sur mesure, nous trouverons ensemble la solution optimale pour votre configuration d'expédition et de logistique.

Pourquoi réserver un rendez-vous de conseil avec nous ?

- Des solutions sur mesure

- Une expertise complète

- Processus simple

- Un partenaire de confiance

Soluzioni personalizzate per esigenze uniche

Consulenza personalizzata per l'impostazione ottimale della spedizione e della logistica

Noi della Posta Svizzera sappiamo che ogni mercato ha le sue sfide uniche. Ecco perché siamo qui per aiutarla ad esportare da o verso la Svizzera. Grazie alla nostra vasta esperienza e all'approccio personalizzato, insieme troveremo la soluzione ottimale per il suo setup di spedizione e logistica.

Perché prenotare una consulenza con noi?

- Soluzioni personalizzate

- Competenza completa

- Processo semplice

- Partner affidabile