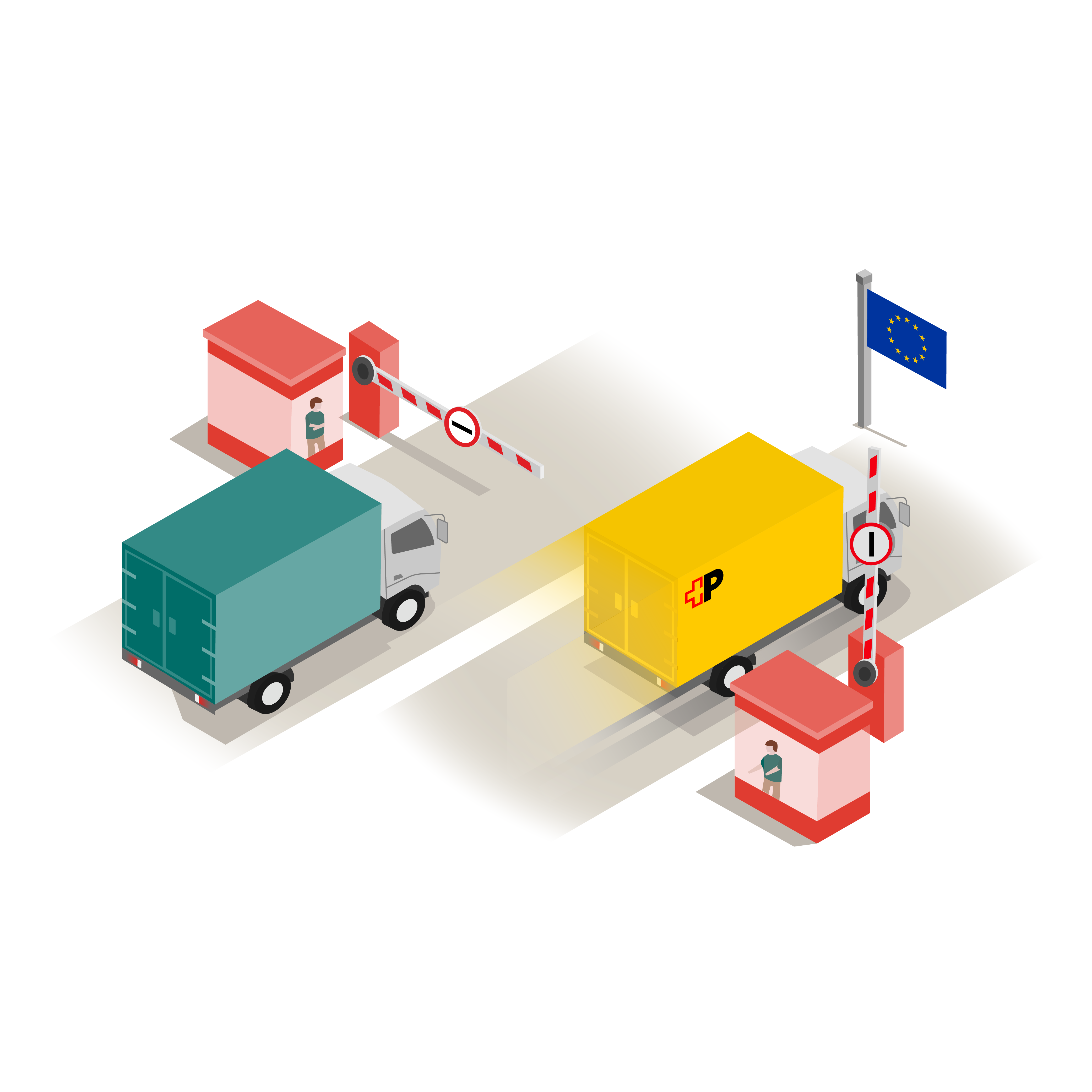

Customs clearance in cross-border e-commerce

Swiss Post eliminates your competitive disadvantage

As a Swiss e-commerce entrepreneur, are customs clearance costs giving you a headache? Are you worried you’ll annoy your customers with customs clearance costs and that this will be reflected in your repurchase rates? Contact Swiss Post – we have the perfect solution for every customs clearance problem. You alone get to decide what this will look like.

Swiss Post helps you manage the problem of unexpected import costs. This gives you the same competitive conditions as your EU competitors. With customs clearance solutions from Swiss Post, it is clear right from the start what import costs a consignment will incur – and you alone decide who will bear which costs.

Swiss Post gives you flexibility when distributing customs clearance costs and state levies between exporter and importer You decide who pays which costs. Depending on your needs, you can do this for each individual shipment, for all consignments to a specific country or generally for all consignments abroad.

Depending on your business model, Swiss Post offers you various customs clearance solutions. Read on to find out!

Would you like to discover your savings potential?

Sales to private recipients in the EU from EUR 150 per order

Tyres, bags, helmets: imagine you are a bicycle accessories dealer selling your goods to customers in the EU. You don’t want your customers to incur import costs for their orders. And you don’t have a business importer based in the EU to whom you can declare your consignments.

This is the solution from Swiss Post:

- You register for tax in Germany.

- You sell your consignments with the delivery condition DDP (delivery duty paid) using the national VAT rates.

- You clear customs for each recipient using your own tax registration. Registration is required for each destination country.

- The parcels are delivered to your customers within the EU without incurring any import costs.

- Customs clearance services, customs duties and (deductible) taxes will be billed to you.

- Swiss Post offers manual or electronic options for this customs clearance solution.

Sales to private recipients in the EU up to EUR 150 per order

Key rings, hats, giveaways: imagine you are a dealer in promotional products selling your goods to customers in the EU. You don’t want your customers to incur import costs for their orders. And you don’t have a business importer based in the EU to whom you can declare your shipments.

This is the solution from Swiss Post:

- You register for tax for Import One Stop Shop (IOSS). You will need an intermediary based in the EU for this.

- You sell your consignments with the delivery condition DDP (delivery duty paid) using the national VAT rates.

- You pay customs duties for each recipient using the IOSS registration in an EU country.

- The parcels are delivered to your customers within the EU without incurring any import costs.

- You will be billed for the customs clearance service.

- You report your monthly sales to the intermediary in the EU for payment of tax duties to the tax authorities.

Want to know more? Find more information here.

Sales to business recipients in the EU with many sales per day

Tyres, bags, helmets: let’s say you’re a bicycle accessories dealer selling your goods to customers in the EU. You don’t want them to incur import costs for their orders and you want them to be able to shop like they would within the EU. You also want to optimize your customs clearance costs. And you don’t have a business importer based in the EU to whom you can declare your shipments.

This is the solution from Swiss Post:

- You register for tax in Germany. You will need a fiscal representative in the EU for this. Registration is carried out via the tax office in Konstanz.

- You sell your consignments with the delivery condition DDP (delivery duty paid). You use the national VAT rate for consignments to Germany. For all other countries in the EU, intra-community deliveries for B2B sales are carried out tax-free.

- You prepare the customs clearance data for each sale and then communicate it. This data can be used to perform customs clearance on much more favourable terms.

- The parcels are delivered to your customers within the EU without incurring any import costs.

- You will be billed for the customs clearance service and duties.

- You report your monthly sales in the EU using the Intrastat and summary declaration.

More information on this page.

Individuelle Lösungen für einzigartige Bedürfnisse

Mit der persönlichen Beratung zum optimalen Versand- und Logistiksetup

Bei der Schweizerischen Post verstehen wir, dass jeder Markt seine eigenen, einzigartigen Herausforderungen hat. Deshalb sind wir hier, um Dich beim Export in die Schweiz oder beim Export aus der Schweiz zu unterstützen. Mit unserer umfassenden Erfahrung und unserem massgeschneiderten Ansatz finden wir gemeinsam die optimale Lösung für Dein Versand- und Logistik-Setup.

Warum einen Beratungstermin bei uns buchen?

-

Massgeschneiderte Lösungen

-

Umfassende Expertise

-

Einfacher Prozess

-

Vertrauenswürdiger Partner

Customised solutions for unique needs

Personalised advice for the optimal shipping and logistics setup

At Swiss Post, we understand that every market has its own unique challenges. That's why we're here to help you export to or from Switzerland. With our extensive experience and customised approach, together we will find the optimal solution for your shipping and logistics setup.

Why book a consultation with us?

- Customised solutions

- Comprehensive expertise

- Simple process

- Trusted partner

Des solutions personnalisées pour des besoins uniques

Un conseil personnalisé pour une configuration optimale de l'expédition et de la logistique

A la Poste Suisse, nous comprenons que chaque marché a ses propres défis uniques. C'est pourquoi nous sommes là pour vous aider à exporter vers la Suisse ou à exporter depuis la Suisse. Grâce à notre vaste expérience et à notre approche sur mesure, nous trouverons ensemble la solution optimale pour votre configuration d'expédition et de logistique.

Pourquoi réserver un rendez-vous de conseil avec nous ?

- Des solutions sur mesure

- Une expertise complète

- Processus simple

- Un partenaire de confiance

Soluzioni personalizzate per esigenze uniche

Consulenza personalizzata per l'impostazione ottimale della spedizione e della logistica

Noi della Posta Svizzera sappiamo che ogni mercato ha le sue sfide uniche. Ecco perché siamo qui per aiutarla ad esportare da o verso la Svizzera. Grazie alla nostra vasta esperienza e all'approccio personalizzato, insieme troveremo la soluzione ottimale per il suo setup di spedizione e logistica.

Perché prenotare una consulenza con noi?

- Soluzioni personalizzate

- Competenza completa

- Processo semplice

- Partner affidabile