- Resources

- VOC tax Switzerland

VOC tax Switzerland – What you need to know in 2025

Would you like to sell perfume to Swiss customers as an online retailer? Good idea – but did you know that VOC tax may be due? If not, we’ll explain everything you need to know about it here. But if you did, we will show you how to avoid customs delays, angry Swiss customers and reduced margins – using Swiss Post’s "SmartGate Flex" service!

What exactly does VOC mean?

VOC stands for: "volatile organic compounds". These are solvents used in various products and industries.

Typical examples are acetol, benzene and propane. VOCs are also contained in products such as paints and varnishes, cleaning products, cosmetic products and perfumes.

Unfortunately, volatile organic compounds have a disadvantage: they foster the formation of ground-level ozone. This is why the Federal Customs Administration (FCA) levies an "incentive tax" on substances and products that contain VOC.

This duty essentially compensates for the fact you’re trading in goods that may have an indirect negative impact on the environment or on people. The famous summer smog, for instance, may be a consequence of VOC emissions. Incentive taxes can be viewed as environmental taxes.

Not all VOCs are subject to tax, though

What substances are subject to incentive tax and are relevant to your business? Take a look at the Ordinance on the Incentive Tax on Volatile Organic Compounds (OVOC) of the Swiss Federal Office for the Environment: here you’ll find a positive list of all substances, substance groups and products that are subject to VOC tax in Switzerland.

How is the incentive tax levied?

Basically, VOC incentive tax is levied on imports into Switzerland. But there are different models that determine how it’s calculated and who actually has to pay it. To explain this in more detail, we must first take a brief look at Incoterms.

Incoterms

Incoterms are trading provisions that govern international trade and standardize delivery and payment conditions. Details such as place of performance, transfer of risk or transport costs can be defined using Incoterms, which gives both contracting parties planning security from the outset.

This is important for you and your customers because you can use Incoterms to govern your payment of VOC incentive tax and other customs costs.

For exports into Switzerland, you will typically use the Incoterms DAP or DDP. We’ll briefly explain these two terms below. If you would like a more detailed explanation, you can go to our e-commerce blog on Incoterms DDP and DAP.

DAP vs. DDP

DAP

DAP stands for "delivery at place", and simply means that whilst you are responsible for transport, all other fees, such as customs, incentive tax and VAT, are borne by the Swiss customers. The customers must pay these fees upon receipt of the consignment, or beforehand by online transfer.

Customs clearance is handled by the relevant service provider or by Swiss Post, who charge the Swiss shopper the relevant fees for this service.

Disadvantages of DAP

DAP is not exactly ideal. As a retailer, you do save yourself additional costs – but at the expense of the customer, who is not exactly going to be happy. This is because the customer only pays for the value of the goods plus shipping at checkout, only to be slapped later on with additional payments they have to make such as incentive tax and customs clearance fees.

Swiss consumers are experienced shoppers in international e-commerce – in other words, they know what they have to pay with DAP, and are more likely to avoid these sorts of online shops. What does this mean for your CVR? As you can well imagine: it’s not good!

DDP

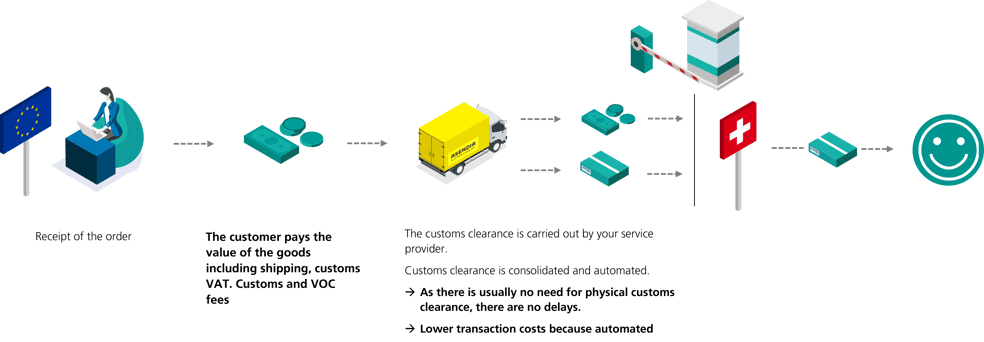

The alternative to DAP is called DDP – Delivered Duty Paid. For you as an online retailer, DDP is the perfect solution for exporting goods to Switzerland.

It’s true this does mean you bear all the costs involved, such as VOC incentive tax, customs and other taxes, but it also means you don’t end up burdening your customer. They pay the price displayed, with all costs included, and can rest assured they won’t be charged any additional fees subsequently.

Special confirmation procedures are the only exception, which are carried out during precious metal control, for instance. Any additional costs are charged to the Swiss shopper.

Benefits of DDP

- No hidden costs for the shopper

- The goods have already been cleared and can be delivered straight away

- Higher conversion rate with the DDP service

You obviously need to consider whether you wish to add these extra costs to your prices, or whether they come out of your margin. Both these approaches have their advantages and disadvantages, but it’s still better than getting the customer to pay unexpected costs.

In contrast to DAP, you’ll massively push your e-commerce KPIs with DDP!

Does the Swiss VOC tax sound complicated? Book a consultation with us and we'll help you overcome this challenge. From the declaration of the VOC steering levy to Incoterms, we are at your side. Together, we'll make your e-commerce business in Switzerland a success.

What customs costs are there actually?

VOC tax in Switzerland is not the only customs cost you may incur when exporting goods into this country. Here’s an overview:

- VAT

- Customs duties (paid to the customs authorities)

- Additional customs fees (for instance for food and precious metals)Customs:

- Customs clearance fees (for customs clearance to be carried out by the service provider)

- Other duties:

- VOC incentive tax

- Special taxes (for tobacco products or alcohol)

As an e-commerce company, how can I deal with the VOC tax in Switzerland?

How can you avoid VOC incentive tax? Pay it yourself – and if so, out of your margin? Or perhaps add it to the selling price instead? We’ll outline 3 options and the consequences they will have for your business.

Option 1: You pay VOC tax from your margin (DDP)

With this option, you’re responsible for all the costs due, and you pay VAT, customs clearance fees, customs duties and incentive taxes.

Your Swiss customer gets their goods delivered to their front door, and they needn’t worry about any additional costs.

You pay the VOC incentive tax from your margin, which reduces the checkout price for the customers, but also cuts into your profits. In return, your CVR increases substantially.

Option 2: You integrate the VOC tax into your prices (DDP)

This is similar to option 1, except that you add the expected VOC taxes to your checkout prices. This will increase your profitability, but it will also increase the price for your customers, and so your conversions are likely to fall as a result of this approach.

You would also need to calculate in the back end how high the VOC costs due will be, or alternatively set a flat rate for them.

Option 3: The shopper pays VOC taxes plus customs clearance fees upon receiving the goods (DAP)

Your only advantage with this option: you don’t have to deal with anything, and you save additional costs, but at the expense of a good customer journey and your reputation.

This is because, with this option, you are essentially passing on all costs to the Swiss shoppers. Not only do they have to make at least one additional payment, they must also (if in doubt) collect their parcel from customs. With that in mind, you’ll need to prepare your customer service for angry callers.

What’s more, the Swiss public has plenty of experience with cross-border shopping and customs. So Swiss shoppers will take a close look at your delivery conditions before they decide to buy something. If they discover potential added costs, they’re likely to buy from the competition instead.

How are customs duties in Switzerland calculated?

One important piece of information first: industrial customs duties were abolished in Switzerland as of 1.1.1024. With a DDP customs clearance solution, all relevant customs clearance data, such as the gross and net weight of a consignment, must nevertheless be transmitted via an interface.

You can find out all about Switzerland’s customs regulations in our guide.

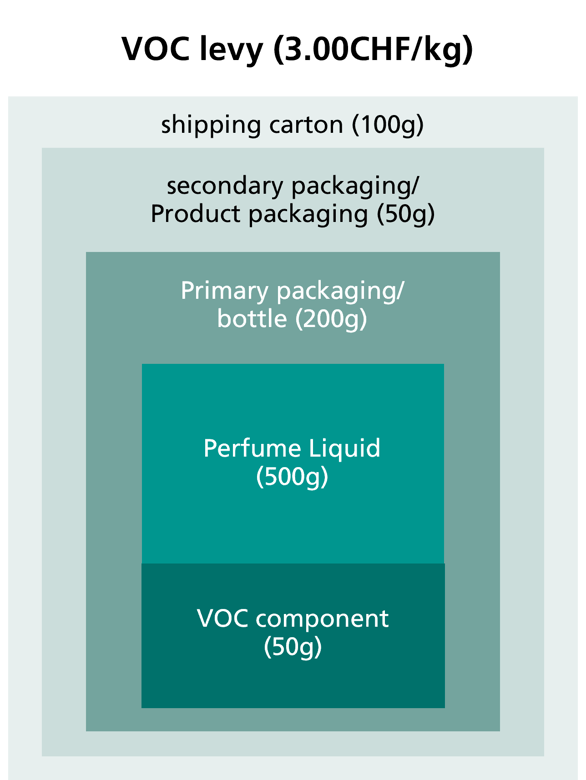

The VOC tax rate in Switzerland is CHF 3.00/kg. It’s very important that the correct VOC weight of a consignment is disclosed to customs. Otherwise, they will simply use the total weight of the parcel to levy the VOC incentive tax, quite in contrast to the customs duty including shipping box!

How can I calculate the VOC tax?

Here is an example:

The following image shows us the example of a perfume and its different packaging components. Here you can clearly tell the difference between the two calculation methods: if just the exact VOC weight is used for the calculation, this gives us a VOC tax amount of just CHF 0.15 (0,05 kg × CHF 3.00).

If, however, the exact VOC weight is not disclosed, Swiss customs will calculate the VOC tax rate using the gross weight of the entire parcel. In this case, instead of a weight of 50 grams for the VOC share of the parcel, you end up with 900 grams for the perfume, the VOC components and all the packaging. This increases the VOC tax to (0,9 kg × CHF 3.00 =) CHF 2.70.

Individual customs clearance vs collective customs clearance

As an e-commerce retailer, you can choose between clearing your consignments via individual or collective customs clearance.

Depending on the shipment structure of your orders, individual or collective customs clearance is more suitable. Collective customs clearance can be cost-intensive, especially if there are many different customs tariff numbers per shipment. Also bear in mind that all shipments will be blocked in the event of a customs audit. You can easily avoid this with individual customs clearance.

Want to find out more? Then take a look at our blog on customs optimization with exports into Switzerland.

How can Swiss Post help you?

With "SmartGate Flex", our all-in-one solution for e-commerce retailers. This will enable you to reduce your VOC costs, clear your goods in a fully automated manner, and benefit from nearly 4'000 drop-off points for potential returns.

Simply send us all the relevant information, including VOC weight details, and we’ll do the rest! The result? A perfect customer journey, happy customers and a better CVR for you!

An overview of the benefits of "SmartGate Flex":

- Cost-optimized delivery

- Automated customs clearance across the entire cross-border e-commerce chain including returns (EU export, CH import, CH export, EU import)

- No delays at the border

- 48–72-hour, end-to-end shipping from the EU to Switzerland

- No more front-door payments thanks to DDP

- 3'903 drop-off points for returns in Switzerland

- Automated customs clearance and transport for returns

- Returns-compliant returns customs clearance process – no new customs payments are incurred

A one-stop shop

Cross-border e-commerce logistics and returns management is all about data. You will skip all physical customs checks if all the data required has been sent properly.

This of course also applies to products that you have to pay VOC tax on. If you then pool all this data via a service provider, they will be able to deal with everything: customs clearance, handling, returns management and a potential customs refund.

There are other benefits too:

- Seeing as the same service provider takes care of everything, all you need is integration, which will improve data security too.

- Just one contact for all processes.

- Use the pre-carriage of the outward transport for the return transport of the returns.

Want minimum customs costs and the perfect customer journey for your Swiss customers? Then what are you waiting for?

Individuelle Lösungen für einzigartige Bedürfnisse

Mit der persönlichen Beratung zum optimalen Versand- und Logistiksetup

Bei der Schweizerischen Post verstehen wir, dass jeder Markt seine eigenen, einzigartigen Herausforderungen hat. Deshalb sind wir hier, um Dich beim Export in die Schweiz oder beim Export aus der Schweiz zu unterstützen. Mit unserer umfassenden Erfahrung und unserem massgeschneiderten Ansatz finden wir gemeinsam die optimale Lösung für Dein Versand- und Logistik-Setup.

Warum einen Beratungstermin bei uns buchen?

-

Massgeschneiderte Lösungen

-

Umfassende Expertise

-

Einfacher Prozess

-

Vertrauenswürdiger Partner

Customised solutions for unique needs

Personalised advice for the optimal shipping and logistics setup

At Swiss Post, we understand that every market has its own unique challenges. That's why we're here to help you export to or from Switzerland. With our extensive experience and customised approach, together we will find the optimal solution for your shipping and logistics setup.

Why book a consultation with us?

- Customised solutions

- Comprehensive expertise

- Simple process

- Trusted partner

Des solutions personnalisées pour des besoins uniques

Un conseil personnalisé pour une configuration optimale de l'expédition et de la logistique

A la Poste Suisse, nous comprenons que chaque marché a ses propres défis uniques. C'est pourquoi nous sommes là pour vous aider à exporter vers la Suisse ou à exporter depuis la Suisse. Grâce à notre vaste expérience et à notre approche sur mesure, nous trouverons ensemble la solution optimale pour votre configuration d'expédition et de logistique.

Pourquoi réserver un rendez-vous de conseil avec nous ?

- Des solutions sur mesure

- Une expertise complète

- Processus simple

- Un partenaire de confiance

Soluzioni personalizzate per esigenze uniche

Consulenza personalizzata per l'impostazione ottimale della spedizione e della logistica

Noi della Posta Svizzera sappiamo che ogni mercato ha le sue sfide uniche. Ecco perché siamo qui per aiutarla ad esportare da o verso la Svizzera. Grazie alla nostra vasta esperienza e all'approccio personalizzato, insieme troveremo la soluzione ottimale per il suo setup di spedizione e logistica.

Perché prenotare una consulenza con noi?

- Soluzioni personalizzate

- Competenza completa

- Processo semplice

- Partner affidabile