- Blog

- Import VAT exemption limits

Innovation

How does an import tax-free limit (value added tax) affect your e-commerce business?

Anyone who ships their products abroad is liable to pay e-commerce VAT. Here you can find out how to prevent your customers from paying annoying fees – and what rules apply in the different countries.

The openness of a market to cross-border e-commerce depends on a wide range of factors. The import regulations of a country play a major role here. But what VAT do you have to pay if you want to export to another country?

It’s the amount that matters

In most countries there is a so-called de minimis value threshold for import tax. This means an amount that is too small to be liable for VAT. In other words, an import tax-free limit (value added tax).

This VAT exemption is very important for exports to other countries. If you know the import tax-free limit (value added tax) of your export country, you can save a lot of money when clearing customs correctly.

However, the de minimis value threshold not only exists for turnover tax, but also for customs duties. However, for simplicity’s sake, this blog will focus on import tax for now.

Who actually benefits from high exemption limits?

As a rule:

- Smaller businesses and foreign mail order companies prefer high VAT exemption limits. Companies that export less expensive goods benefit the most. This leads to lower fees, less paperwork and, last but not least, usually fewer delays at customs. Returns management is also easier. You can read more about the returns process in our blog: https://ecommerce.asendia.ch/en/blog/optimised-returns-processes

- Domestic manufacturers, on the other hand, prefer low exemption limits. If these are set high, foreign sellers gain a considerable advantage. For domestic companies, it doesn’t matter how high the value of the goods is.

- The consumer, at the end of the chain, naturally prefers high exemption limits. This makes cross-border purchases cheaper. In addition, high exemption limits create more competition, which leads to more choice and lower prices.

What influence does the import tax-free limit (value added tax) have on your customer satisfaction?

There are other reasons why you can benefit from high tax-free allowances in the destination country of your consumer.

There is not only potential for savings on VAT. Customs duties and import taxes are incurred by the recipient during customs clearance. This type of shipping is called DAP shipping.

You don't know the difference between DAP and DDP yet? These are Incoterms that describe two different types of customs clearance: https://international.post.ch/en/blog/incoterms-ddp-and-dap

Don’t annoy your customers – it’s that simple

Generally speaking, DAP items usually annoy customers. They have to pay the VAT and customs duties directly to the mail carrier at the door. If no one is at home, there are often tedious delays in delivery.

For customers, it is already annoying that they have to pay not only the VAT but also the customs clearance fee. The latter is sometimes even higher. This often causes incomprehension.

However, if the value of the product is below the VAT exemption limit, these fees do not apply. The customer does not get annoyed – and will perhaps buy from your online shop again next time. So if you sell low-priced goods, you should go for DAP shipping. Since there are no fees, the consignments can pass through customs more quickly, and this is another advantage.

- Professional tip:

With DAP shipping, it is a great customer service to add the VAT exemption limit of the respective country to the order information. Customers are often confused when ordering from abroad because they are not familiar with the applicable fees.

Calculating the total costs is sometimes a little complicated, as customs duties must sometimes be paid in addition to VAT. There are various calculators for this, called total landed cost calculators.

How do you achieve the greatest cost benefits?

As already mentioned, DAP shipping is not the only solution: if you decide to use DDP shipping, you handle all the formalities yourself. You can of course charge the fees to the end customer. With this type of shipping, customers are often more satisfied because they don’t have to pay unexpected costs.

Want to know how much DDP customs clearance costs you? Find out with our Optimizer 4.0.

To find out whether you benefit from the exemption limits or not, you can ask yourself the following questions:

- What value does the VAT exemption limit actually apply to?

- How much do the exemption limits amount to in your export country?

- Are there exceptions for individual products?

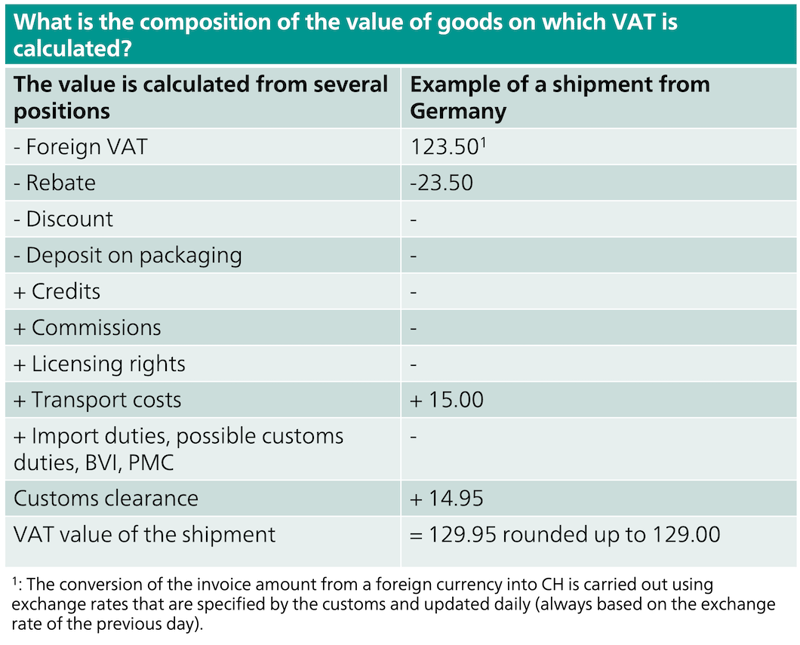

The amount of VAT depends on the value of your goods. But what does that actually mean? The value of goods is not only the pure selling price of your product. It is calculated as follows:

As you can see, the relevant VAT value includes not only the net value of the products, but also the customs clearance fee, import duties and transport costs. VAT is then paid on this amount.

This is the situation in Switzerland

Since the import regulations differ greatly from country to country, we will concentrate here on Switzerland and later on the EU. As the legal situation changes frequently, the following information cannot be guaranteed.

In Switzerland, no VAT charges apply if the calculated amount is lower than CHF 5 per customs declaration. The same applies to customs duties. However, these are levied on the gross weight and not the value of the goods.

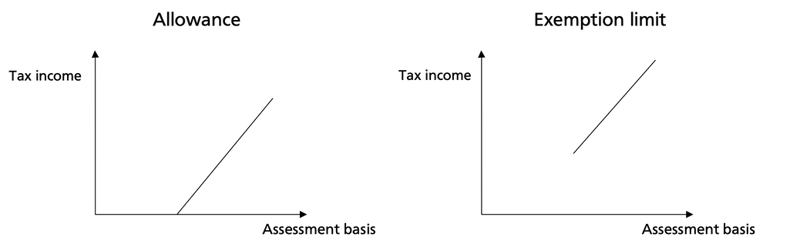

But be careful: until now, we have always used the word exemption limit. Strictly speaking, however, it is a tax-free amount. So if the CHF 5 is exceeded, then the entire tax duties become due – plus the CHF 5 mentioned.

There are two different VAT rates for imports:

- 7.7% (for the vast majority of goods)

- 2.5% (for preferential goods such as books).

With an exemption amount of CHF 5, this means that the maximum value of the goods is CHF 65 (at 7.7%) or CHF 200 (at 2.5%), up to which no VAT is payable.

But beware, since the partial revision of the VAT law in Switzerland (01.01.2019), the new mail order regulation has also come into force.

Here, foreign mail order companies that make an annual turnover of CHF 100,000 with this type of small goods (goods with a low value that fall under the VAT exemption limits) in Switzerland must register in Switzerland and will henceforth be subject to VAT. You can find more detailed information on the Swiss Post website: Swiss Mail Order Regulations.

You want to ship to Switzerland, but you still lack the facts? Our Switzerland E-Commerce Report provides you with the information you need.

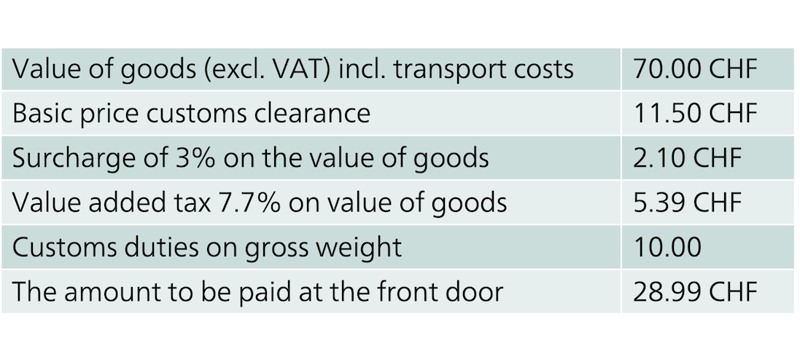

For example, if a customer orders clothes in Germany for CHF 70 (purchase price + transport costs), the costs would be as follows:

All relevant costs for postal customs clearance to Switzerland can be found here on this website about customs clearance.

The basic customs clearance price varies

The basic customs clearance price to Switzerland varies depending on the country of origin. Goods from Italy, France, Austria and Germany will be cleared through customs for the lower price of CHF 11.50. From all other countries, customs clearance costs CHF 16.

In the table above you can see that the tax to be paid is only CHF 5.39, while the price for handling is CHF 13.60 (CHF 11.50 CHF + CHF 2.10). If the customer has to pay this unexpected fee, it usually causes problems. For this value of goods, DDP shipping is recommended. Note that in this case, customs duties must also be paid on the gross weight.

Import individual customs clearance with Swiss Post’s DDP customs clearance solution is much more attractively priced than that of standard private customers. Are you interested? Then find out more about your optimal export setup with Optimizer 4.0.

Find out how you can keep the gross weight down and thus avoid customs duties in our blog!

Import tax-free limit (value added tax) for online trading with the EU – and the tax reform

Within the EU, there are no customs duties or import taxes. However, if you export from third countries, such as Switzerland, to the EU, fees are due.

All imports from non-EU countries have to go through customs. However, customs duties are only charged for goods over EUR 150. There is also an exemption limit for e-commerce turnover tax: EUR 22 (in some countries it is EUR 10). With this ordinary DAP customs clearance, the recipient pays the fees and charges himself or herself if his or her order does not fall within the VAT and customs exemption limit.

Settlement of e-commerce VAT within the EU

The following provisions still currently apply:

EU-EU

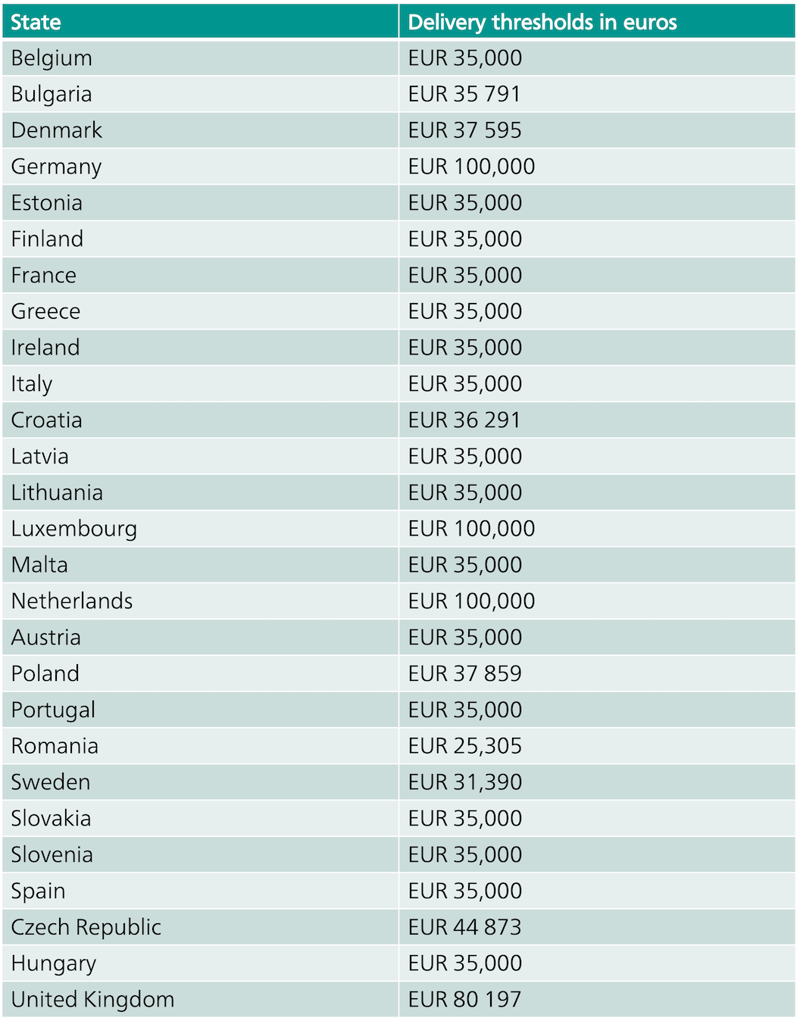

Companies from the EU that export to other EU countries can send goods up to a certain delivery threshold without having to register. In this case, you have to pay the e-commerce sales taxes in your own country.

If the delivery threshold is exceeded, the company must register for tax purposes in the exporting country.

Example: a German company sends goods worth EUR 20,000 to private customers in Austria. The revenue is settled with German VAT.

This is how EU customs clearance works

Non EU - EU:

To avoid paying e-commerce VAT when you send a product to an EU country, there is an easy trick: simply register for tax purposes in the transit country, i.e. where the first EU border is crossed.

Registration allows parcels to be sent from the transit country to the rest of the EU: so-called intra-Community delivery. As long as no delivery threshold is exceeded, no further registration in another country is necessary. The delivery threshold is calculated per year: it is between EUR 35,000 and EUR 100,000. However, this regulation only applies to B2C shipments.

The big advantage of this solution is liquidity. Since the purchase tax does not have to be paid until later, creditworthiness is not a problem at any time.

Are you overburdened with legal regulations? We can help you with a free consultation.

The EU tax reform and what it means

Since 1 July 2021, the VAT reform came into force in the EU. What does that mean for you?

The individual thresholds of the individual countries (listed above) will be abolished. In the future, a standard value of EUR 10,000 per year will apply. You can send your products to EU countries up to this amount without registration.

Important: The standard threshold does not apply per country, but for the entire EU. If it is exceeded, you must register with the One-Stop Shop (OSS) of the respective country. In this way, the VAT is transferred to the country where your delivery arrives.

For online retailers from Switzerland, the reform means that in future it will no longer be possible to register in just one EU country. Since 1 July, you have to register in all EU destination countries – there is also no longer a VAT exemption limit.

At first glance, this doesn’t appear to be good news. But there is a solution: online retailers from Switzerland can join the Import One-Stop Shop (IOSS).

The special case of Norway

Norway is not in the EU, but it is a member of EFTA. Here, too, there are changes in the VAT system:

Previously, imports up to a value of 350 Norwegian krone (equivalent of about CHF 35) were exempt from value-added tax, excise duty and customs duties. However, this exemption was completely revoked and no longer applies as of 1 April 2020.

Retailers who continue to ship low-value goods to Norway can register for the VOEC programme. This means that you are registered in Norway and pay VAT this way. This is possible if the value of the goods does not exceed 3,000 Norwegian krone (about CHF 300).

Without the appropriate registration, the goods are cleared through customs at the border as normal. However, there is a fee for customs clearance, which may delay the delivery.

You can find more information on the website of the Norwegian Tax Administration: https://www.skatteetaten.no/en/business-and-organisation/vat-and-duties/vat/foreign/e-commerce-voec/

Which exemption limits apply where?

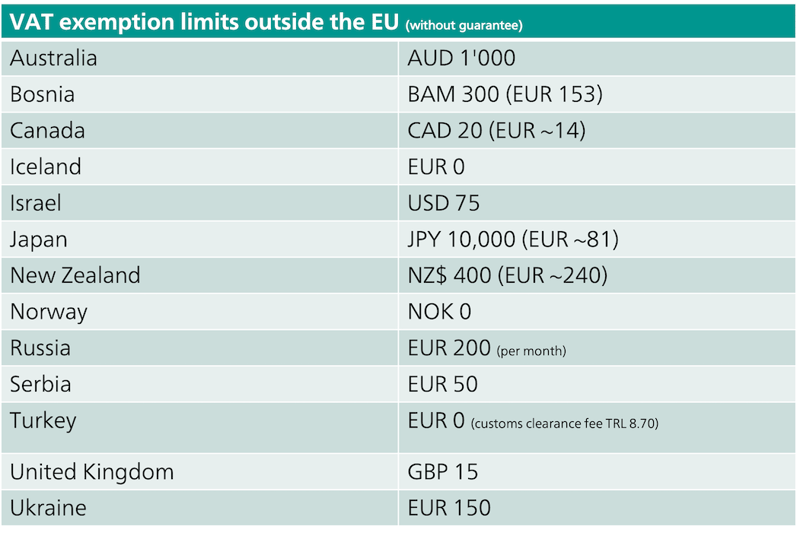

In the following overview you will find the most important VAT exemption limits for countries outside the EU:

Are you interested in cross-border shipping, but don’t yet know which shipping solution is right for you? Book your consultation appointment now. We’d be happy to help.